Award-winning PDF software

Resale-certificate.pdf - portal ct gov

This provision should only be applied to such items as are resale or re-sale. “The provisions of this section shall not apply to, and shall be inapplicable to, transactions in nonreciprocal trade for the sale of items for commercial purposes.” (emphasis added). Thus one can buy a copy of “A Song for Our Mothers” from the internet, and even purchase a valid copy from a reputable bookseller. If I own that book, and that copy is not an authentic copy of a real book from which I have purchased it, then no law in Illinois would prohibit me from reselling the book on the open market. However, an authentic copy of A Song for Our Mothers that I have purchased from the author could still be a resale without the provisions of this section as mentioned by the statute. As a result I could still be convicted.

How to get a resale certificate in connecticut

Find the purchaser's date of birth. The purchaser's Date of Birth will be printed on the sales tax certificate. Enter the purchaser's sales tax ID number found on the sales tax certificate onto this website. Check the box to indicate the license is valid and the transaction is complete. Click “Proceed to Complete”. You will receive an email confirmation once the transaction is completed. If your license shows that there are outstanding items, go online and submit a payment request. When your application is processed, you will receive a notice of payment and your license will be mailed to you. If you do not have the purchaser's sales tax ID number on file at your business, then you need to obtain the purchaser's ID number before making an online transaction to avoid paying a fine. When purchasing from a new license-issuing entity, make sure you know what the purchaser's.

Printable connecticut sales tax exemption certificates

However, the Connecticut Secretary of State may limit the exemption from re-use for all taxable transactions (including sales to non-residents). In New York, the blanket certificate is available as well, but it is considered to be restricted use. New York does not allow the sale to resident of the New York State Resale Certificate Program. The use of a blanket resale certificate in Connecticut is considered to be restricted use. Connecticut does not allow the sale to resident of the Connecticut Resale Certificate Program. The use of a blanket resale certificate in New York State is considered to be limited. New York does not allow the sale to resident of the New York Taxpayers Resale Certificate Program. The use of a blanket resale certificate in New York City is considered to be limited. New York City does not allow the sale to resident of the Taxpayers Resale Certificate Program.

Connecticut sales & use tax guide - avalara

Com account or .com website, your sales tax exemption will be revoked. Sales tax exemption - It's important to know just how many people owe sales taxes in your area. The Connecticut state tax collector's office issues a yearly list. Some retailers in my neighborhood get calls every Wednesday from the state tax collector's office. They ask if our addresses are on the tax list. For example, there are tax collectors in New Haven, Hartford and West Haven who call our house every Wednesday morning to see if we owe tax on any of our sales that day. I usually try to show the state tax collector that my house is empty so that they don't have to call the other houses. Sometimes, though, the sales tax collectors will find out where the cash is going to be coming in. That means there is a potential liability on my account. Since the collection.

Sales tax exemption statement form - interstate + lakeland

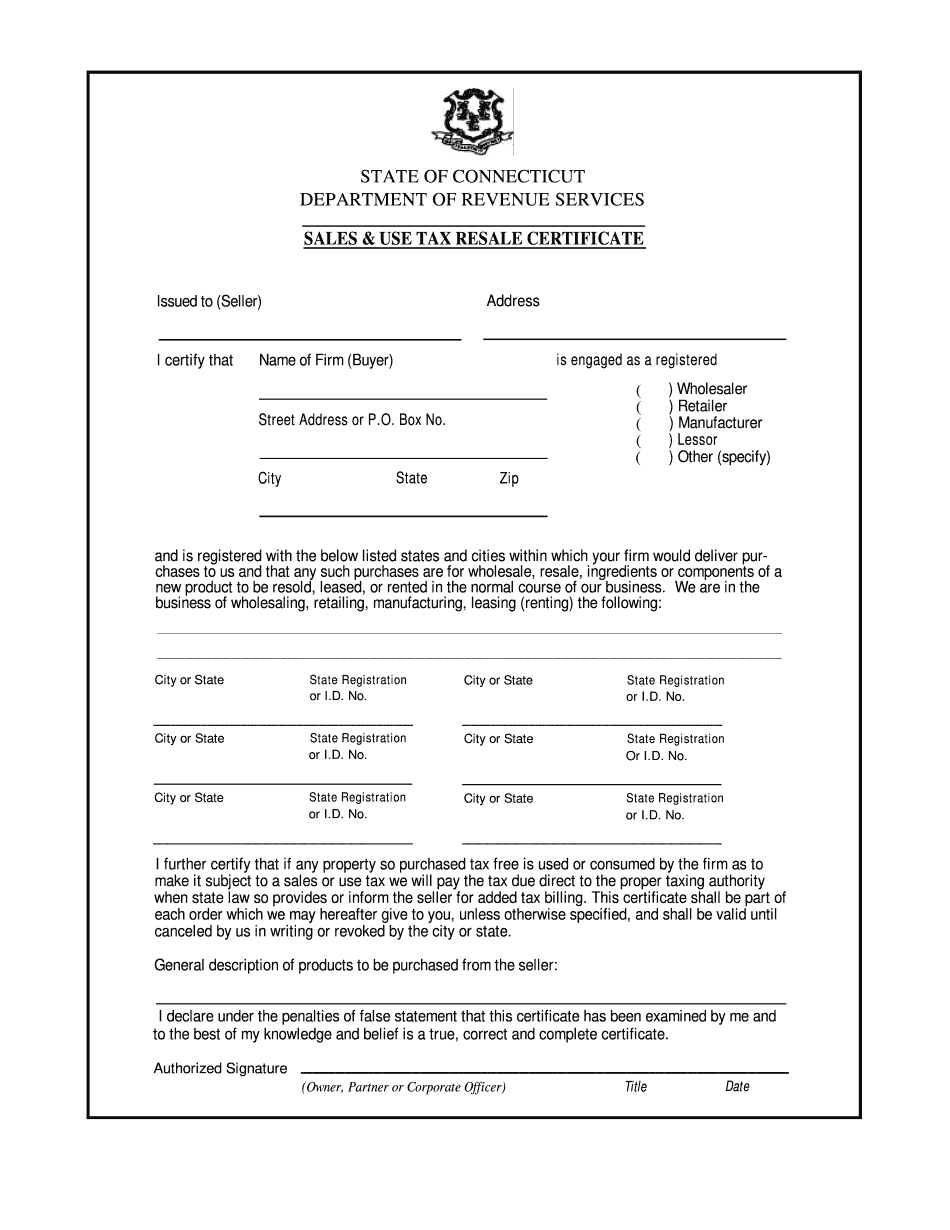

PDF) This document includes a declaration that you have reviewed and signed by you and a statement showing you the number of copies of the CT Sales & Use Tax Resale Certificate you will buy to resale to purchasers. All the information is true and correct to the best of my knowledge. I have no conflicts, financial or otherwise, as to the information presented in this statement. Acknowledging that I am representing myself, by filling in the blanks, or am I representing a business entity as the seller (whether in the CT sales & use tax resale Certificate or otherwise) and agree to hold harmless, indemnify and hold harmless, the company, and their employees, agents or representatives from any and all loss, damage, liability, loss of commissions, any loss of interest, penalty, costs or expense, or any other damages arising from any claims, suits, demands or proceedings based upon.