Award-winning PDF software

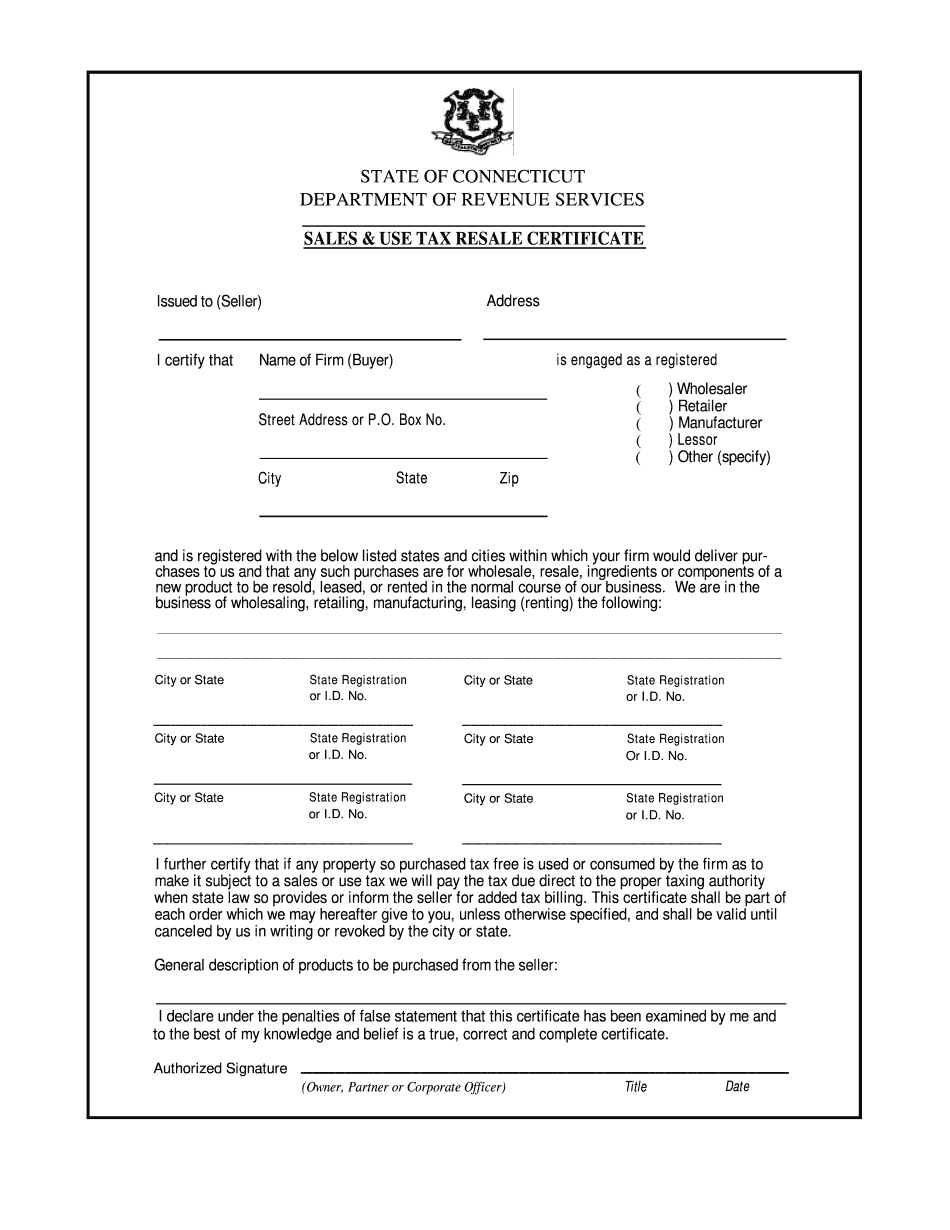

Ct Resale Certificate: What You Should Know

CT-118, Form for Taxable Services Sales Tax Deduction Form CT-118 is a paper form that's used by the state treasurer to determine the deduction for income tax paid on taxable services sales. The exemption certificates are for sale by their registrars in all 50 states and in the District of Columbia. There are two types of certificates: “N” (Resale certificates) : Resale certificate to a customer for use as a basis for the purchase of tangible personal property or taxable services. Note the exception for certain items of motor vehicles. “G” (Guarantee): A guaranty form used by sellers to assure themselves that the seller is selling items of tangible personal property or taxable services that are exempt from the tax. When a reseller of telecommunication services is required to purchase, obtain or redeem the Connecticut Resale Exemption certificate, the person selling or leasing telecommunication service in Connecticut must follow the following steps: The Connecticut Resale Certificate for Sales of Telecommunications Service, CT.gov The Connecticut Registry of Exemptions (CT.gov) will not accept photocopies of Form CT-120, Resale Certificate, CT.gov. They should be ordered at the time of sale and should be kept with the Resale Certificate. Telecommunication Sales Tax Exemption Certificates; A Guide for Collectors The Connecticut Sales Tax Exemption Certificate for Sales of Telecommunication Services is a general purpose license. The purpose for which it is issued by the State Treasurer is to enable the state or a political subdivision of the state to grant the purchaser of any telephone or other telecommunication equipment or service exempt from tax an exemption certificate so long as the purchaser agrees that the phone or other telecommunication equipment and the service may be sold to third persons so long as the person who buys the equipment or service is subject to sales and use tax. The Connecticut Resale Certificate for Sales of Telecommunication Services, CT.gov Form CT-117, Resale Certificate for Telecommunication Services Exemption Form, is the application for a Telecommunication Sales Tax Exemption Certificate. This form is the application for a Telecommunication Sales Tax Exemption Certificate. A salesperson who seeks a sales tax exemption certificate using the Connecticut Resale Certificate Form CT-118, CT.

Online solutions help you to to organize your document management and strengthen the productivity of the workflow. Carry out the short manual in an effort to total Ct Resale Certificate, keep away from errors and furnish it within a timely way:

How to complete a Ct Resale Certificate on-line:

- On the web site when using the kind, simply click Initiate Now and go for the editor.

- Use the clues to fill out the related fields.

- Include your individual info and call knowledge.

- Make convinced that you simply enter appropriate details and numbers in correct fields.

- Carefully look at the subject material within the type also as grammar and spelling.

- Refer that can help part for those who have any problems or tackle our Support workforce.

- Put an digital signature on the Ct Resale Certificate when using the guidance of Signal Resource.

- Once the shape is finished, press Completed.

- Distribute the completely ready type via e-mail or fax, print it out or help you save on your own device.

PDF editor makes it possible for you to definitely make variations towards your Ct Resale Certificate from any on-line related equipment, customise it as outlined by your requirements, indication it electronically and distribute in several strategies.